Get paid 30 days faster with targeted collection strategies

See exactly which invoices to chase today, which customers need calls vs emails, and which payment promises are credible. Stop treating all late payers the same - collect faster with strategies tailored to actual payment behavior.

How We Help Businesses Get Paid Faster

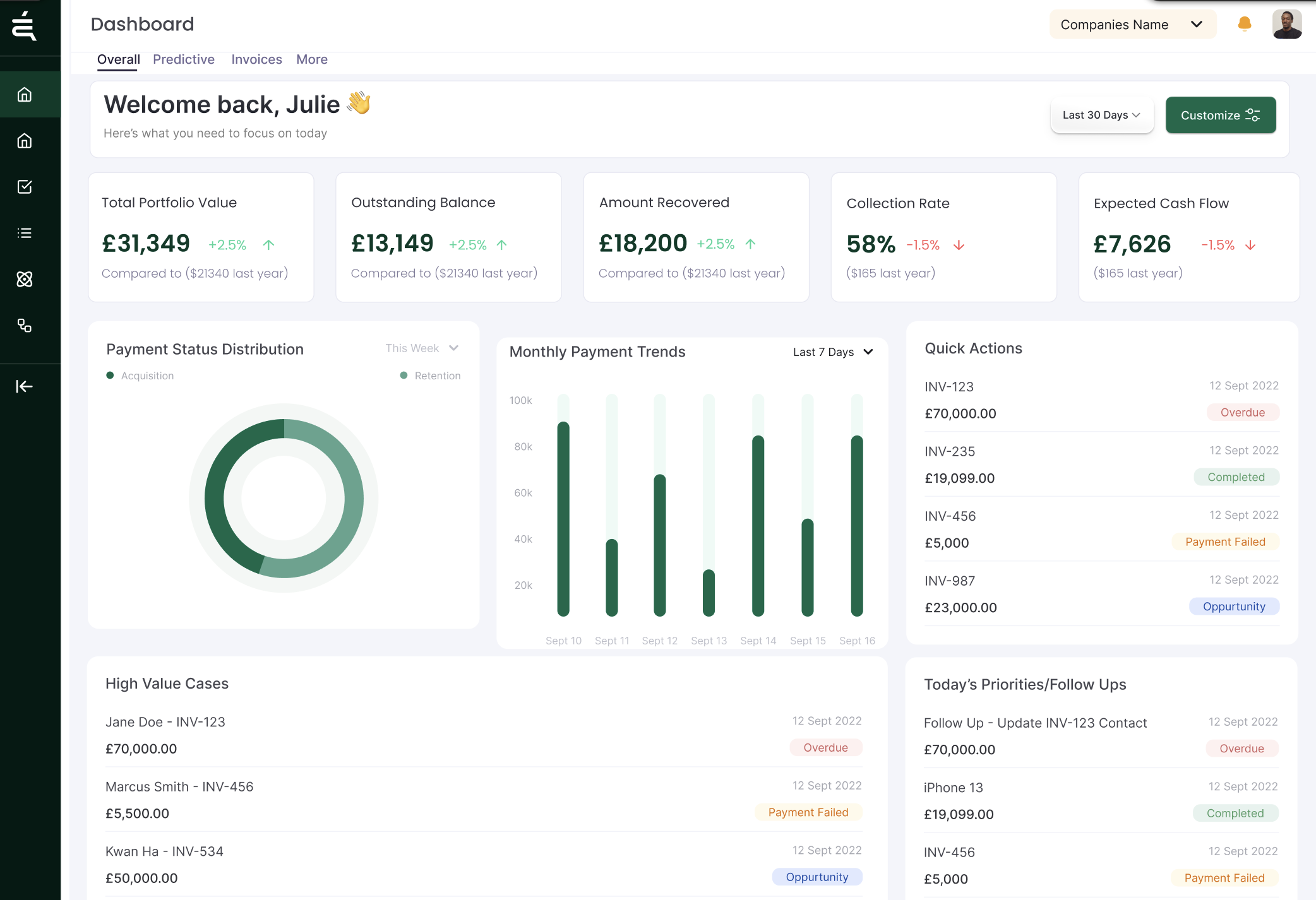

Know which invoices to chase first every morning

Start each day with a prioritized action list based on risk, value, and collection probability. Chase the invoices that need immediate attention, wait on those that'll pay anyway. Clear priorities, measurable impact.

Stop wasting time on customers who'll pay anyway

Focus effort where it matters. System identifies which customers are just slow vs actually risky. Stop chasing invoices headed for payment, focus on the ones that need intervention.

See which collection tactics actually work

Track response rates by channel, message type, and customer segment. Double down on what works, stop doing what doesn't. Data-driven collection strategy replaces gut feel and guesswork.

Get paid faster with smart escalation

Automatic escalation from friendly reminders to urgent notices based on payment behavior and invoice age. Maintain relationships with good customers while getting tough with serial late payers.

Collect more without damaging relationships

Balance speed with relationship quality. System recommends appropriate tone and channel based on customer history and value. Professional, consistent communication that maintains goodwill while accelerating payment.

Reduce collection costs while improving results

Automation handles routine collections at near-zero marginal cost. Your team focuses only on high-value cases needing personal attention. Better results with lower cost per collected pound.

Improve collection success rates by 31%

Targeted strategies based on customer behavior and payment patterns drive significantly higher collection rates. Right message, right channel, right time - optimized for each customer segment.

Reduce average DSO by 23%

Faster collections directly improve working capital. Early intervention with at-risk invoices prevents long payment cycles. Average DSO reduction of 23% translates to significant cash flow improvement.

65% reduction in manual collection time

Automated workflows handle routine follow-ups, status tracking, and payment monitoring. Finance teams report 15-20 hours saved weekly, redirected to strategic activities and complex cases.